It's not what happens to you, but how you react to it that matters.

Date: 16-Aug-2025

Hey {{first_name | AI enthusiast}},

And just when you think you’ve seen it all…there’s always One More Thing in AI.

In this edition:

Best,

Renjit

PS: Founders- In case you want to prototype and test AI automation /Agentic AI deployment in your business, schedule an appointment here:

Deepmind's world model is a stepping stone to AGI and no one is talking about it

Imagine typing a short text and instantly stepping into a 3D world that you can explore and alter. That leap is what DeepMind just unveiled with Genie 3.

Why it matters

• A world model that goes beyond static simulation. Genie 3 creates real-time, interactive environments that run at 24 fps and in 720p resolution. It builds on Genie 2 and Veo 3.

🤖 It supports rich training for AI agents. Robots or virtual agents can practice navigating a warehouse or ski slope, using prompts to create scenarios like adding deer on a slope or changing the weather.

• It remembers what it creates. The model retains details from previous frames, staying physically consistent—an ability that wasn’t hard-coded but emerged through its design.

💡 It helps agents learn by doing. DeepMind showed an agent reaching goals like walking to a green trash compactor or a red forklift inside a generated warehouse. The environment’s consistency makes that possible.

• It aims toward AGI. DeepMind calls Genie 3 a key stepping stone on the path to artificial general intelligence—by giving AI systems simulated worlds where they can learn, adapt, and act.

🌱 It remains in preview. Right now, Genie 3 is in limited release for researchers and creators. It still faces challenges in geographic accuracy and handling multiple agents—but the potential is clear.

So what?

Genie 3 isn’t just tech for games or demos because it gives agents a sandbox that mimics reality.

If it scales, it could teach AI systems how to think, predict, and act just like we do.

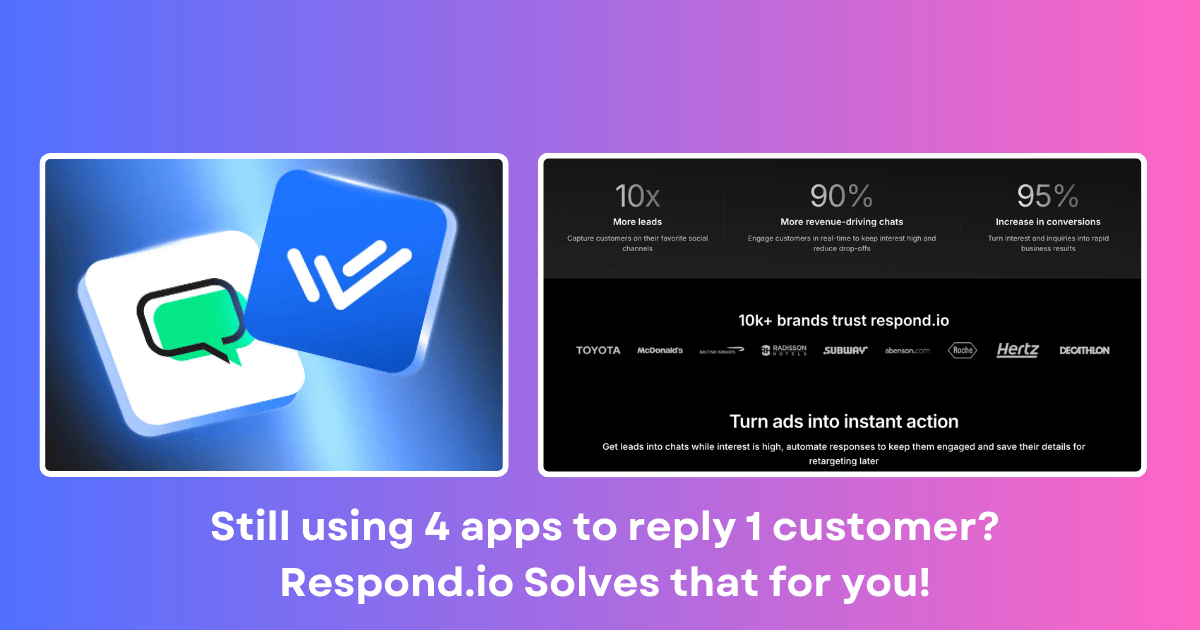

Respond to customers on all channels!

Don’t limit your team inbox to basic functions for WhatsApp and Instagram. Centralize calls, chats and emails on respond.io to manage leads, automate tasks and scale revenue on every channel.

10x your leads across channels that matter!

Capture prospects from every touch point, then engage and close deals fast with a powerful unified inbox including WhatsApp, Messenger, Telegram and also Click to Chat Ads.

(affiliate partner)

Startup Ideas inspired by Genie 3

1. AI-Driven Simulation Platforms

• Training-as-a-Service for AI Agents

Offer an API for companies to create realistic, low-cost simulated environments for training robots, drones, or autonomous vehicles without expensive real-world trials.

• Synthetic Data Generation

Build a platform to create labeled 3D training data for computer vision startups, particularly in industries with scarce or sensitive data (e.g., defense, healthcare, mining).

⸻

_____

2. Enterprise Workflow Simulations

• Warehouse and Logistics Optimization 📦

Generate custom simulations of fulfillment centers to test different layouts, robotics flows, and worker allocation before implementing changes in the real world.

• Factory Safety and Compliance Training

Let manufacturers run immersive “what-if” training scenarios in a virtual replica of their site for safety drills, machine handling, and process compliance.

⸻

3. Industry-Specific Scenario Testing

• Urban Planning and Smart Cities 🏙️

Provide municipalities and real estate developers with rapid, interactive simulations of neighborhoods to test infrastructure, traffic flows, and climate resilience strategies.

• Financial Risk Visualization

Simulate disaster or market-crash scenarios and integrate them with economic models to give banks, insurers, and governments better decision tools.

⸻

4. Consumer-Facing Products

• Custom Game World Creation Tools 🎮

Let indie game developers or streamers instantly turn text prompts into interactive game levels or storytelling environments without coding.

• Virtual Event Experiences

Create real-time, user-generated “event spaces” for remote concerts, trade shows, or fan meet-ups where attendees can shape the world around them.

⸻

5. Education & Skills Training

• Virtual Field Trips 🏫

Schools could turn historical events or scientific concepts into explorable 3D worlds that change based on the student’s questions.

• Job Skills Simulators

Offer immersive, hands-on training for high-skill jobs like surgery, firefighting, or aviation without real-world risk.

⸻

6. Early R&D and Tooling Opportunities

• Agent Behavior Analytics

Build dashboards to analyze how AI agents learn and act in Genie 3 environments—turning simulation logs into insights for performance improvement.

• Multi-Agent Collaboration Testing

Create environments where multiple AI agents coordinate or compete—valuable for swarm robotics, trading algorithms, or autonomous fleet management.

DeepMind Genie 3 Startup Opportunities Analysis

The convergence of DeepMind's Genie 3 world-model technology with growing demand for AI-powered simulations creates unprecedented startup opportunities across multiple sectors. These 12 startup ideas represent a combined Total Addressable Market of over $2 trillion by 2030-2034, with near-term opportunities exceeding $150 billion in rapidly growing segments like AI training services, enterprise simulations, and creator economy tools.

For a deep dive into the TAM, Distribution, Strategies and guidance on the initial steps to take, I would request you to subscribe to the newsletter

Genie 3's breakthrough capabilities in real-time interactive 3D environment generation, combined with its enhanced memory and physics understanding, position it as foundational technology for a new generation of simulation-powered businesses. While the technology remains in research preview, the competitive landscape shows substantial venture funding ($300M+ rounds) and commercial adoption accelerating across all analyzed verticals.

AI-Driven Simulation Platforms

Training-as-a-Service for AI Agents

Market Opportunity: The AI training dataset market represents $8.6-9.58 billion by 2029-2030 (CAGR 21.5-27.7%), while robotic simulation reaches $223.63 billion by 2034 (CAGR 22.95%). Military simulation adds another $16.79 billion by 2029, creating a massive addressable market for specialized AI agent training environments.

Distribution Strategy: This venture should pursue a multi-channel approach targeting enterprise customers through direct sales, strategic partnerships with robotics manufacturers (Universal Robots, Boston Dynamics), and cloud marketplace presence (AWS, Google Cloud). Defense contractors represent the highest-value segment, with companies like General Dynamics and Lockheed Martin requiring ITAR-compliant solutions for autonomous systems training.

Initial Steps: Start with a $2-5 million seed round focusing on single-use case APIs (autonomous vehicle edge cases). The MVP should leverage pre-trained models rather than building from scratch, using cloud-native architecture for scalability. Early customer acquisition should target mid-market manufacturers with proven ROI metrics showing time-to-deployment improvements and cost savings. The 6-18 month sales cycle requires strong pilot programs and reference customers.

Synthetic Data Generation Platform

Market Opportunity: The synthetic data market shows explosive growth from $218-432 million in 2024 to $1.8-8.9 billion by 2030-2034 (CAGR 31-45%). Computer vision applications dominate with 41% market share, while healthcare and defense segments command premium pricing for specialized 3D labeled datasets.

Distribution Strategy: Target Fortune 100 technology companies, defense contractors, and healthcare AI firms through direct enterprise sales. Government channels offer significant opportunities, with DHS SVIP currently funding synthetic data projects and DOD SBIR providing defense applications funding. Cloud provider partnerships (AWS, Azure, GCP) enable marketplace distribution while MLOps platform integrations (Databricks, MLflow) facilitate customer adoption.

Initial Steps: Focus initially on one vertical (healthcare or defense) with a $3-8 million seed round for platform development. The technical MVP should include pre-trained foundation models, domain-specific fine-tuning capabilities, and basic API functionality. Customer acquisition should leverage SBIR/STTR funding to de-risk early development while establishing government relationships. Success metrics include data quality scores versus real data and compliance audit pass rates.

Enterprise Workflow Simulations

Warehouse and Logistics Optimization

Market Opportunity: Warehouse automation represents $23 billion in 2023 growing to $41 billion by 2027 (15% CAGR), while logistics automation reaches $90 billion by 2030 (14.7% CAGR). Only 5% of warehouses are currently automated, creating massive opportunity for simulation-driven optimization tools.

Distribution Strategy: Partner with systems integrators like Dematic and Honeywell Intelligrated for credible market entry. Major logistics companies represent prime targets: Amazon (investing 80% more in logistics infrastructure), UPS ($4 billion automation investment), and FedEx (expanding AI-powered robotics initiatives). Channel partnerships with WMS/ERP vendors (SAP, Oracle, Manhattan Associates) provide direct customer access.

Initial Steps: Begin with 30-60 day proof-of-concept programs targeting specific use cases like cold storage or e-commerce fulfillment. The technical platform requires real-time data integration with existing WMS systems, 3D visualization capabilities, and cloud-based deployment. Target 42% five-year OPEX reduction as the primary ROI message, leveraging proven AMR success metrics for customer acquisition.

Factory Safety and Compliance Training

Market Opportunity: HSE consulting and training services reach $280.45 billion by 2030 (9.32% CAGR), with OSHA compliance training specifically growing to $3.2 billion by 2033 (9.2% CAGR). Corporate compliance training shows $38.48 billion by 2034, driven by nearly 1,000 different OSHA standards requiring specialized training.

Distribution Strategy: Partner with safety consultants and insurance providers offering workers' compensation premium discounts. Target high-risk manufacturing industries (automotive, aerospace, chemical processing) through industry associations and engineering consulting firms. The regulatory trigger event strategy focuses on companies after OSHA citations or safety incidents.

Initial Steps: Develop VR/AR training modules for specific compliance requirements, integrating with existing learning management systems. Customer acquisition should target new facility launches through partnerships with facility design consultants. The business model combines subscription tiers with compliance tracking automation, addressing the 72% reduction in workplace injuries achieved through digital safety technologies.

Industry-Specific Scenario Testing

Urban Planning and Smart Cities

Market Opportunity: Urban planning software grows from $3.68 billion to $14.39 billion by 2034 (14.42% CAGR), while smart cities reach $3.7 trillion by 2030 (29.4% CAGR). Government agencies represent 31% of the market with infrastructure investment supported by $100 million annually through 2026 via the Infrastructure Investment Jobs Act.

Distribution Strategy: Navigate complex government procurement through RFP-based processes with 12-24 month sales cycles. Partner with established consulting firms (McKinsey, Accenture, AECOM) for credibility and distribution. Academic partnerships provide research validation while system integrator relationships accelerate deployment.

Smart City of the future

Initial Steps: Target 5-10 mid-sized municipalities ($50K-$200K pilots) focusing on specific use cases like flood resilience or traffic optimization. The platform requires GIS integration (ESRI, Bentley), cloud infrastructure compliance (AWS GovCloud), and adherence to open geospatial standards. Federal government contracts through GSA Schedulerepresent the ultimate scaling opportunity.

Financial Risk Visualization

Market Opportunity: Financial risk management software reaches $10.79 billion by 2032 (14.5% CAGR), while broader risk management grows to $28.31 billion by 2030 (16.75% CAGR). Increasing regulatory pressure from Basel III, Dodd-Frank, and MiFID II drives enterprise adoption despite Bloomberg's market dominance.

Distribution Strategy: Challenge Bloomberg's high-cost position through specialized scenario testing capabilities. Target top 50 banks and insurance companies with regulatory compliance focus, while pursuing government contracts with Federal Reserve, Treasury Department, and state banking regulators. Average deal sizes range $500K-$2M annually for large institutions.

Initial Steps: Develop regulatory compliance-first solutions addressing specific stress testing requirements. The technical platform requires integration with market data feeds (Bloomberg, Reuters), existing risk systems, and portfolio management platforms. Security certifications (SOC 2 Type II, ISO 27001) are essential for financial services adoption.

Consumer-Facing Products

Custom Game World Creation Tools

Market Opportunity: Game development tools represent $1.83 billion by 2034, while the creator economy in gaming reaches $230.4 billion by 2034 (23.2% CAGR). 52% of development tools now offer AI features, creating opportunity for specialized text-to-interactive game generation.

Distribution Strategy: Target indie developers (39% of game developer market) through Unity Asset Store, Unreal Marketplace, and direct API integration. Streaming platform partnerships with Twitch and YouTube Gaming enable creator economy monetization. Educational institutions provide additional distribution through game development programs.

Initial Steps: Launch with freemium model offering 5 generations monthly, scaling to creator tiers ($19/month) and studio subscriptions ($99/month). The technical stack requires real-time rendering (WebGL/WebGPU), cloud-based GPU processing, and integration with existing game engines. Customer acquisition focuses on content marketing through tutorial videos and developer community engagement.

Virtual Event Experiences

Market Opportunity: Virtual events grow from $98.07 billion to $297.16 billion by 2030 (20.0% CAGR), driven by permanent behavioral shifts with 67% of events now hybrid/virtual versus 23% pre-pandemic. 89% of companies plan to continue virtual events with 40% budget increases.

Distribution Strategy: Target mid-market businesses and creator economy integration through subscription tiers and revenue-sharing models. Partner with event management companies and corporate training providers for distribution. Enterprise sales focus on HR, marketing, and training departments seeking engaging virtual collaboration solutions.

Initial Steps: Develop real-time streaming capabilities (WebRTC) with 3D graphics integration and spatial audio. The monetization strategy combines subscription tiers (Creator Pro $49/month, Business $199/month) with 5-15% transaction fees on ticketed events. Customer acquisition leverages 30-day full-feature trials and referral programs.

Education and Skills Training

Virtual Field Trips

Market Opportunity: VR/AR education reaches $75 billion by 2033 (20.26% CAGR), while K-12 technology spending grows to $209.7 billion by 2033 (24.5% CAGR). 93% of teachers believe VR would be helpful in classroom teaching, with 40% of K-12 schools expected to incorporate AR/VR by 2024.

Distribution Strategy: Partner with educational technology distributors (School Specialty, Pitsco) and curriculum publishers (Pearson, McGraw-Hill) for integrated solutions. Target STEM-forward districts with existing technology budgets through direct sales to superintendents and curriculum directors.

Initial Steps: Develop COPPA/FERPA compliant platform with curriculum-aligned content meeting state education standards. The technical platform requires WebXR compatibility, adaptive learning algorithms, and LMS integration (Google Classroom, Canvas). Pilot programs with 5-10 progressive school districts provide case studies for broader market penetration.

Job Skills Simulators

Market Opportunity: Virtual training and simulation reach $1.185 trillion by 2033 (12.8% CAGR), with medical simulation growing to $4.17 billion by 2030 (16.80% CAGR) and pilot training reaching $24.86 billion by 2032 (12.7% CAGR).

Distribution Strategy: Target academic medical centers and teaching hospitals for healthcare applications, while pursuing training organizations and airlines for aviation. Group purchasing organizations (GPOs) provide healthcare distribution channels, while FAA certification requirements create barriers but also competitive moats in aviation.

Initial Steps: Focus on single vertical (healthcare or aviation) requiring regulatory compliance from day one. Medical applications need FDA clearance and quality standards (ISO 13485), while aviation requires FAA certification for training devices. Customer acquisition targets chief medical officers, simulation coordinators, and airline training departments with evidence-based outcomes research.

Early R&D and Tooling

Agent Behavior Analytics

Market Opportunity: AI development tools grow from $4.86 billion to $26.03 billion by 2030 (27.1% CAGR), while MLOps reaches $19.55 billion by 2032 (35.5% CAGR). The broader AI software market projects $826.70 billion by 2030 with specialized analytics commanding premium pricing.

Distribution Strategy: Target AI research organizations (Google DeepMind, OpenAI, Anthropic) and Fortune 500 enterprise AI teams through technical content marketing and conference presence at NeurIPS, ICML, and AAAI. MLOps platform partnerships enable integration with existing workflows.

Initial Steps: Build MVP focusing on specific simulation environments with $2-5 million seed funding for technical team development. The freemium model with usage-based enterprise pricing targets academic customers for initial validation. Open-source components build developer mindshare while enabling enterprise upsell opportunities.

Multi-Agent Collaboration Testing

Market Opportunity: Robotic simulator market reaches $120.3 billion by 2032 (22.95% CAGR), while algorithmic trading grows to $38.4 billion by 2029 (14.9% CAGR). Multi-agent systems represent emerging high-value applications in both robotics and trading infrastructure.

Distribution Strategy: Choose initial vertical (robotics versus trading) for focused development. Partnership with system integrators and OEM manufacturers provides robotics distribution, while prop trading firms and hedge funds offer high-value trading applications.

Initial Steps: Develop standardized benchmarking protocols for multi-agent systems with $3-7 million seed fundingfor platform development. The technical platform requires high-performance distributed simulation, real-time coordination protocols, and latency optimization for trading applications (<1ms requirements). Customer acquisition targets specialized quantitative trading infrastructure and advanced robotics applications.

Strategic Investment Considerations

The current AI funding environment strongly favors infrastructure plays over foundation models, with AI startups raising $110 billion in 2024 (62% increase). 49 US AI startups raised $100M+ rounds, indicating substantial investor appetite for well-positioned opportunities.

Funding requirements vary significantly by vertical complexity: simple consumer applications ($2-5M seed rounds) versus enterprise platforms requiring regulatory compliance ($5-10M seeds). Strategic investors from NVIDIA, major robotics companies, and cloud providers offer both capital and distribution advantages.

Success factors across all opportunities include technical differentiation versus incumbents, customer validation through strong pilot programs, regulatory compliance capabilities, domain expertise combined with technical execution, and strategic partnerships with key industry players.

The optimal market entry window spans the next 18-24 months, as established players focus on horizontal scaling rather than vertical specialization. Early entrants with focused approaches can establish competitive moats before larger companies enter specialized markets.

These opportunities represent the emergence of simulation-first business models enabled by breakthrough AI capabilities, creating potential for category-defining companies across multiple trillion-dollar markets. Enjoy building!

Voice AI Security That Impacts Your Bottom Line

Learn how enterprise IT and ops leaders are using compliance to unlock Voice AI scale—deploying faster, reducing risk, and accelerating procurement.

This guide shows why HIPAA, GDPR, and SOC 2 are now deal-makers, not blockers. From securing PHI to routing across 100+ sites, see how security-first platforms reduce friction and enable real-world rollout across healthcare, insurance, and more.

Do you want to reach a high-quality audience?

To sponsor this Newsletter and gain customers. This newsletter is subscribed to by solopreneurs, startup founders and business leaders: