Date: 25-Jan-2025

Hey {{first_name | AI enthusiast}},

The Godmother of AI raises funds for a world model and the valuation jump from roughly $1B to $5B suggests markets see “world models” as a foundational shift, not a feature.

Plus A16Z published an insightful State of the Markets report that suggests that the AI investments are going to bear fruit. It is worth reading.

Plus, there is a treasure trove of Claude Skills that you can use in your business. What is not to like?

Table of Contents

Hope you enjoy this power-packed edition!

PS: If you want to unleash the power of AI agents to grow your business, setup time speak to me, here»

Fei-Fei Li’s World Labs is reportedly raising at a $5B valuation

Fei Fei Li: Godmother of AI

Fei-Fei Li’s World Labs is reportedly raising at a $5B valuation, per Bloomberg.

Some reports suggest the round could reach $500M. If completed, this would reprice World Labs sharply from roughly $1B in 2024, when it raised $230M coming out of stealth. Fei-Fei Li is also known as the Godmother of AI for her work on computer vision and the ImageNet system.

The core bet: “world models” that generate editable, explorable 3D environments, not just text or flat images.

That matters because most 3D pipelines still rely on hand-built polygon meshes, stitching scenes from countless triangles before rendering. World Labs’ Marble takes a different path using 3D Gaussian splatting, representing scenes as millions of semi-transparent points with higher visual fidelity.

For physics and robotics, it also outputs collider meshes, simpler shapes optimized for speed over realism.

It is significant for five reasons.

First, it reframes AI output.

Most generative AI stops at text, images, or video. Fei-Fei Li’s World Labs is betting on AI that generates interactive 3D worlds you can edit, simulate, and build software on.

Second, it creates a new platform layer.

If “world models” become reliable, they sit beneath gaming, robotics, AR, simulation, and digital twins. That shifts value from apps to infrastructure.

Third, it breaks the traditional 3D cost curve.

Hand-built polygon meshes are slow, expensive, and talent-heavy. Tech like 3D Gaussian splatting lowers the time and skill needed to create rich 3D environments.

Fourth, it links AI directly to the physical world.

Collider meshes make generated worlds usable for physics, robotics, and training. That moves AI from content generation to decision-making and control.

Fifth, the valuation signals investor belief in spatial AI.

A jump from roughly $1B to $5B suggests markets see “world models” as a foundational shift, not a feature.

Net effect:

This is less about better graphics and more about AI becoming a system that understands and simulates reality.

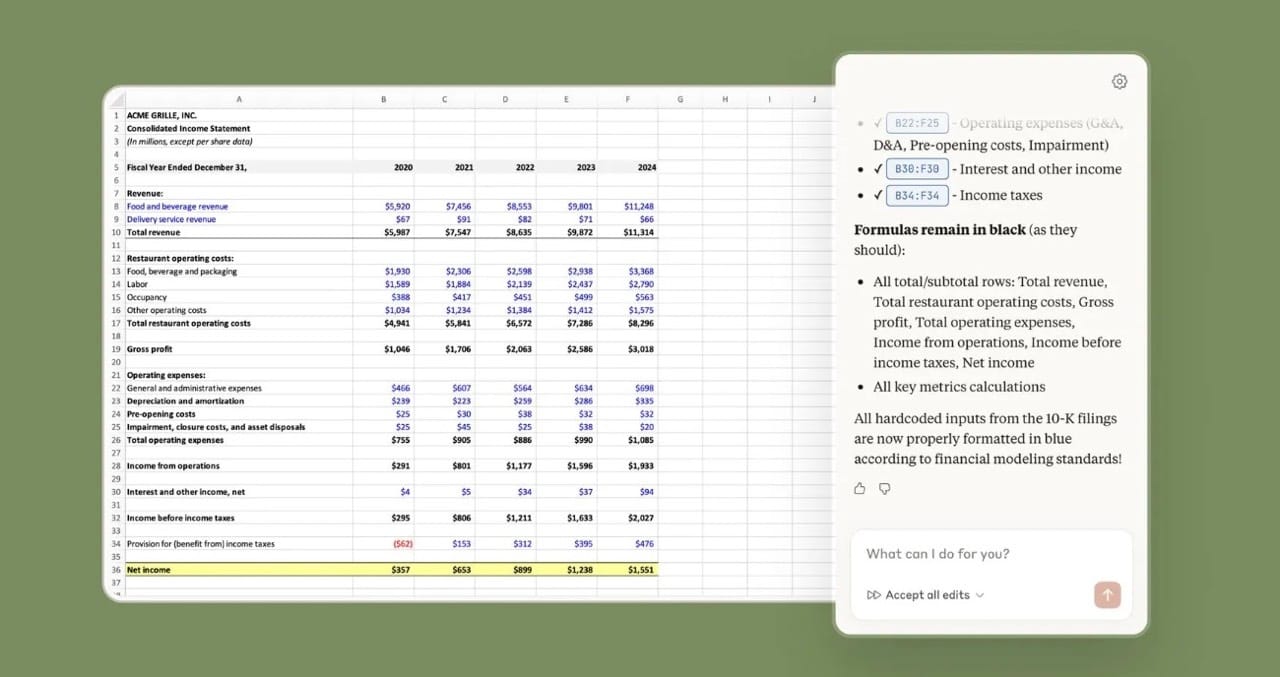

Claude is now available directly in Excel

Anthropic expands Claude access with native Excel integration for Pro users.

Claude now supports multi-file drag and drop, preserves existing cells, and runs longer sessions with auto compaction.

Claude in Excel

This turns Claude into a full-stack spreadsheet assistant.

Claude lives in the spreadsheet sidebar. It scans the entire workbook: sheets, formulas, and links. You can chat with the model directly inside Excel.

You can ask anything. Test formulas without fear. Claude updates cells safely, keeps logic intact, and explains every change.

Errors get fixed instantly: REF!, VALUE!, and circular references are spotted, explained, and resolved in context.

Financial Models get smarter, faster: SaaS valuations, projections, CAC payback, or retention analysis from CSVs.

Claude assembles or completes models while preserving structure and assumptions.

So what?

Spreadsheets are the operating system of business. Whoever controls them shapes how decisions get made. Surprised that Microsoft Copilot is not able to deliver this type of a result, even after being embedded inside Excel!

It lowers the cost of real analysis. Founders and operators can build finance-grade models without deep Excel expertise.

Most investment memos don’t fail because the thinking is wrong...

They fail because every deal reaches an investment committee with a different level of rigor, structure, and context.

Some are deeply researched. Others are rushed. The result is time spent debating the memo instead of the investment.

This Agentic AI workflow was built to fix that. (see video)

It starts with three inputs only: the company name, available financials, and any pre-diligence material already in hand.

From there, it automatically pulls external market context, reviews how the company presents itself publicly...

...and searches internal IC notes, prior memos, and comparable deals to anchor the analysis in institutional memory.

The memo is written sequentially by four AI agents.

1) Business overview first.

2) Competitive positioning next.

3) Financial analysis after.

4) Executive summary last.

The output is a familiar IC-ready memo, but with consistent structure and depth across every deal, making comparison easier and discussion more focused.

Judgment stays human (we still want a review before it goes to print). Preparation of the memo becomes reliable.

If IC conversations are drifting toward reconciling memos instead of debating decisions, this Agentic AI workflow helps reset the baseline.

See video»

Setup time using this link to install this workflow for your company:

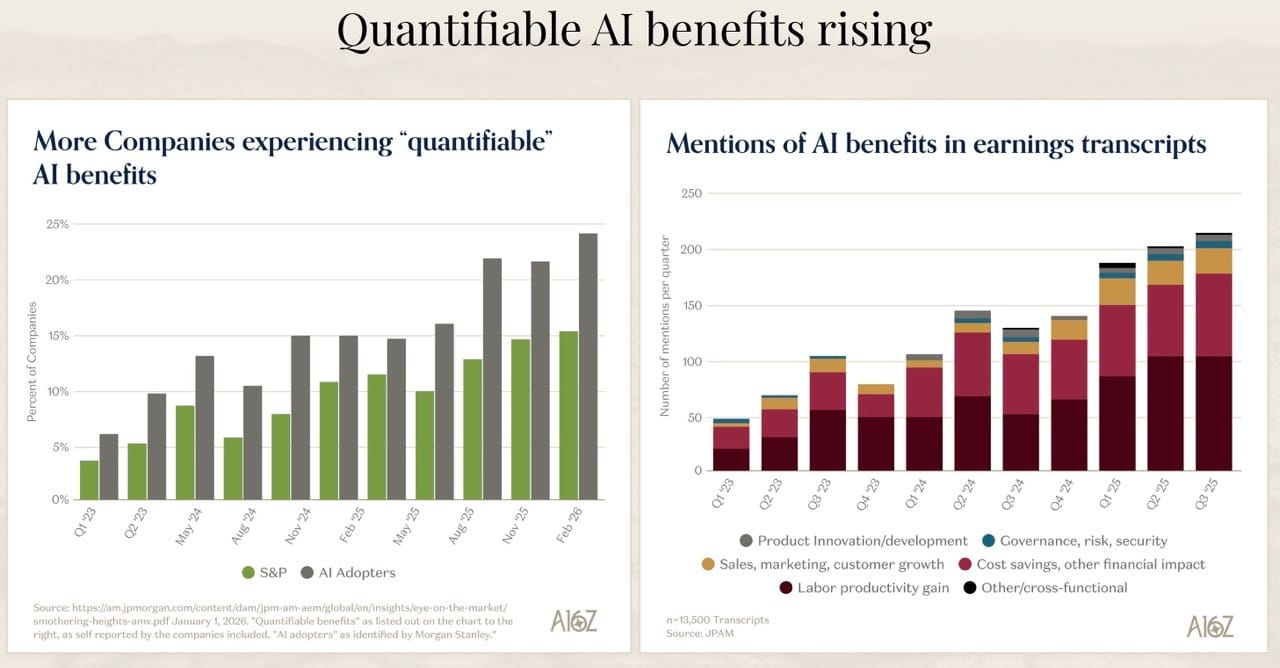

A16Z on the State of the Markets

a16Z's latest State of the Markets report, released January 21, 2026, analyzes public and private market trends, with a strong focus on AI's rapid growth.

Companies are reporting more AI benefits (Q3 2025 reports)

Key Highlights

Revenue growth surged for top private AI companies in 2025, especially the top quartile and decile, following power law dynamics where winners dominate.

Private unicorns exceeded $5 trillion in aggregate value, driven by leading firms; public markets show similar patterns with tech giants pulling ahead.

55% of AI growth is concentrated in a few private companies, including a16z portfolio firms generating $26.5 billion in revenue versus $14.1 billion from others.

AI Market Analysis

Demand outstrips supply, with 7-8-year-old Google TPUs at 100% utilization and newer GPUs over 80%.

The Jevons Paradox applies: cheaper AI tokens and compute increase usage, particularly when monetized indirectly.

Unlike past bubbles, fundamentals support sustained expansion toward trillion-dollar outcomes. (please note that this comes from a VC who is investing into AI companies, so please take this with a grain of salt)

Access the full slide deck at a16z.com/state-of-markets/.[a16z]

Treasure Trove of Claude Skills

Claude Skills are a good way to do those repeated tasks in an elegant manner. Here on GitHub, we found a treasure trove of skills that you can install and use in Claude.

If you need me to write about how to install these skills, let me know.