"The willing, destiny guides them; the unwilling, destiny drags them."

Date: 5-Oct-2025

Hey {{first_name | AI enthusiast}},

And just when you think you’ve seen it all…there’s always One More Thing in AI.

In this edition:

Also: introducing you to our podcast edition for those of you who want to listen to it on the go. Check it out on your favorite platforms:

I hope you enjoy this edition!

Best,

Renjit

PS: If you want to check out how to implement AI in your Insurance broking business and get more revenue with the same number of employees, book time here:

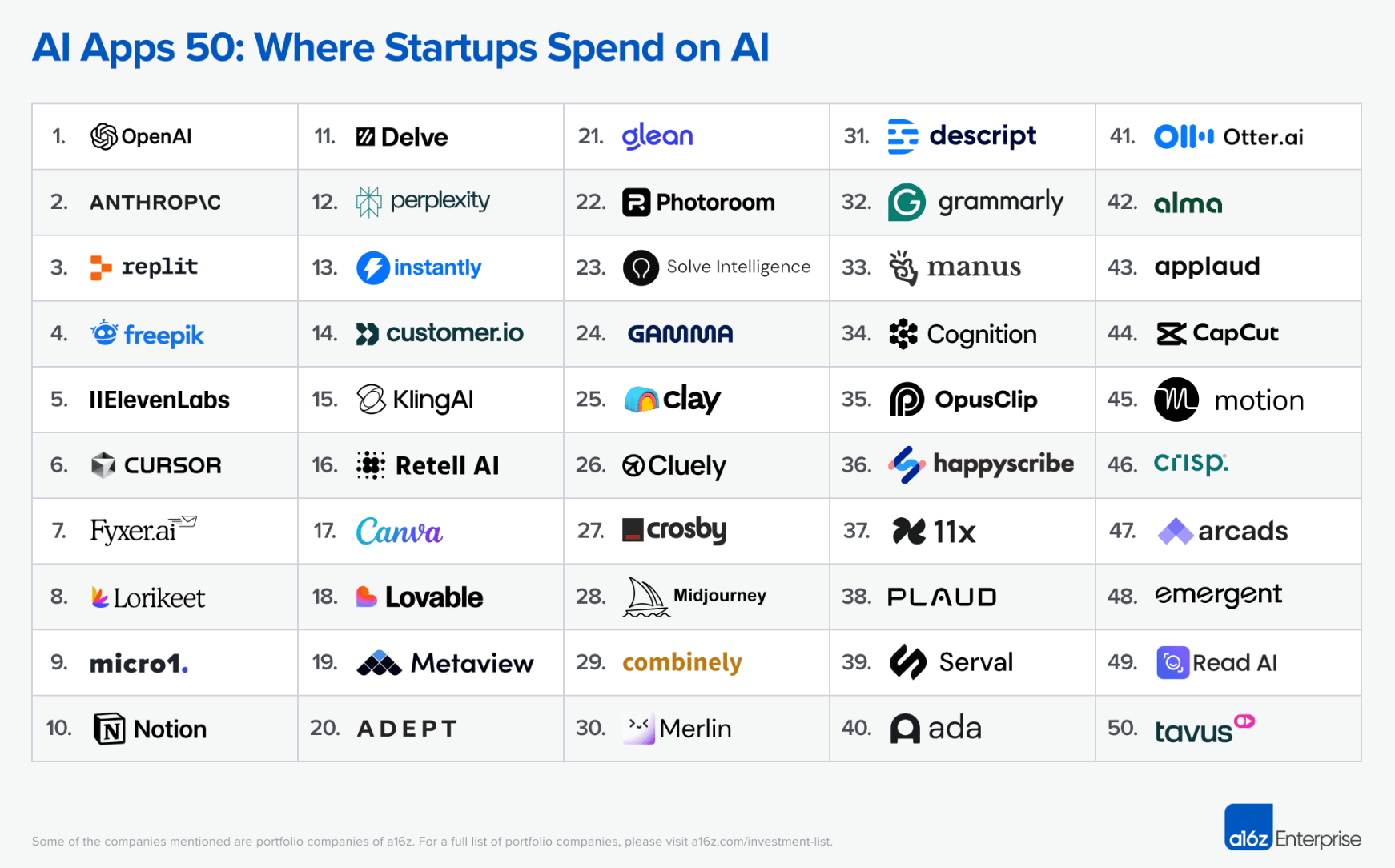

The Real Story Behind AI Startup Spending

Every founder talks about AI, but few know where the money actually goes.

A16Z and Mercury recently dug into the data from over 200,000 startups to find out which AI tools are attracting real dollars and not just buzz.

image from A16z blog

How the analysis worked

Mercury’s (fintech in the US), transaction data (June–August 2025) was analyzed to see how startups spend on AI software.

The focus was on application-layer companies; the tools that apply AI in day-to-day workflows, not the infrastructure like GPUs or cloud platforms.

A new generation of AI-native companies

Horizontal tools dominate the spend

Roughly 60% of spending went to horizontal tools- apps that anyone in a company can use to boost productivity.

The usual giants top the list: OpenAI and Anthropic, with Perplexity and Merlin AI close behind.

But new workspaces like Notion and Manus are blending LLMs directly into daily workflows, suggesting there’s no single “winner” yet.

Meetings are being rewritten by AI. Tools like Fyxer, Happyscribe, and Otter AI automatically take notes, summarize, or draft follow-ups. Newer entrants such as Cluely even offer real-time feedback during calls.

Surprisingly, creative tools now count as horizontal software too. What once belonged only to marketing teams is now open to everyone. Freepik, ElevenLabs, Canva, Midjourney, and Descript let anyone design, voice, or produce content with ease. Why? My guess is for ads.

Vertical tools: helpers or replacements?

The other 40% of spend went to vertical applications, AI designed for specific roles.

Most of these tools augment humans rather than replace them. They automate the repetitive work so teams can focus on higher-value tasks.

A few startups, however, are taking a bolder approach; acting as AI employees that handle workflows end-to-end.

Examples include Crosby Legal (AI law firm), Cognition (AI engineer), and 11x (AI go-to-market team).

Across industries, clear patterns are emerging for tool usage:

• Customer service tools like Lorikeet and Ada.

• Sales and GTM platforms such as Clay and Instantly.

• HR and recruiting with Micro1 and Metaview.

• Operations and compliance with Delve and Combinely.

For founders, that’s a clue to where early automation ROI already exists.

Vibe coding: AI for builders

One of the fastest-growing categories is “vibe coding”- platforms that let anyone build software with the help of AI.

Replit leads this trend, ranking third overall. It offers agentic development tools that run autonomously for hours, with built-in hosting and security- perfect for small teams that move fast.

Interestingly, while Lovable performs better on consumer traffic charts, Replit earns 15 times more revenue from business users. Enterprises need reliability more than novelty.

From consumer to enterprise, fast

Almost 70% of the companies on the list began as consumer tools before expanding into enterprise use. AI has made that jump easier. Teams adopt what employees already use personally. OpenAI, for instance, has shifted from mostly consumer revenue to an even 50/50 split.

So what?

If there’s a pattern, it’s this: AI spending follows utility. Startups aren’t buying hype; they’re paying for tools that save time, improve creativity, or automate real work.

Horizontal tools win adoption first. Vertical tools will soon show deeper ROI.

And “vibe coding” platforms could power the next wave of business automation.

🚨 OpenAI just pulled off the heist of the century. And nobody's watching.

They just turned ChatGPT into a shopping mall.

You can now BUY stuff directly in chat. Today: Etsy. Tomorrow: 1 MILLION

Shopify stores.

But here's the real play 👇

They copied Visa's homework:

• 700+ million people use ChatGPT every week

• OpenAI takes a cut of EVERY. SINGLE. PURCHASE.

• Users pay nothing extra

• Stores pay the fee (and they'll gladly do it)

Why this is genius:

OpenAI is bleeding money. Those $20/month subscriptions? Not even close to covering their costs.

But a small % cut of every purchase transaction? That's BILLIONS.

The knockout punch: They're not competing with Amazon. They're becoming the tollbooth EVERYONE has to drive through.

Ask ChatGPT for research on running shoes → See options → Buy in chat → OpenAI gets paid. Every. Single. Time.

Watch what happens next:

• Your company will NEED to be in ChatGPT

• Google is scrambling to catch up (too late). I wrote about Google's Agentic payments protocol (theory). Well, OpenAI just went live with Agentic payments!

• Etsy stock already up 16% after this was announced

• This becomes how Gen Z shops for everything

The old internet: Google search finds it, Amazon sells it.

The new internet: ChatGPT does both. And takes a cut. There is a reason why Amazon does not allow the Open AI bot to search it!

We're watching the biggest business model shift since the Search Engine.

Most people don't see it yet.

(This is from a post I wrote on LinkedIn)

Learn Prompting (Act as if you are a JP Morgan Banker)

I tried out this prompt on Genspark (which is building an agentic platform)

You are a technology banker at JPMorgan Chase preparing for a meeting with the CEO and CFO of Nvidia. Prepare a five-page presentation that includes the latest news, earnings and a peer comparison.I got a pretty detailed presentation with Slide 1: Executive Summary & Market Position

Current market valuation ($187.62 stock price as of Oct 3, 2025)

AI market dominance: 70-95% market share in AI data center chips

Key value drivers including "insane" Blackwell platform demand

Strategic positioning in the AI revolution

Slide 2: Latest Financial Performance Analysis

Q4 FY2024 record results: $22.1B revenue (+265% YoY)

Data Center segment: $18.4B quarterly revenue (+409% YoY)

Exceptional 76.7% non-GAAP gross margins

Strong cash position: $26B total liquidity

Slide 3: Recent News & Strategic Developments

Blackwell platform: entire 2025 production sold out

92% GPU market share and strategic customer concentration

Major partnerships with top cloud providers

Market expansion insights and growth drivers

Slide 4: Comprehensive Peer Comparison Analysis

Detailed NVIDIA vs AMD vs Intel financial metrics

Revenue, margins, and growth rate comparisons

Market positioning and competitive advantages analysis

Visual charts showing NVIDIA's superior performance

Slide 5: Investment Banking Opportunities & Recommendations

Capital markets opportunities: debt offerings, supply chain financing

M&A advisory potential in AI software ecosystem

Strategic financing options and capital structure optimization

JPMorgan Chase engagement plan with timeline

Genspark is worth experimenting with, in my opinion!