Special Edition #16 (part 2): One More Thing in AI takes on the Reddit S1

Date: 9-Mar-2024

Financial Analysis of Reddit’s S1 - Powered by GPT4 : Part 2

In case you have not read the first part here it is»

Source Reddit S1

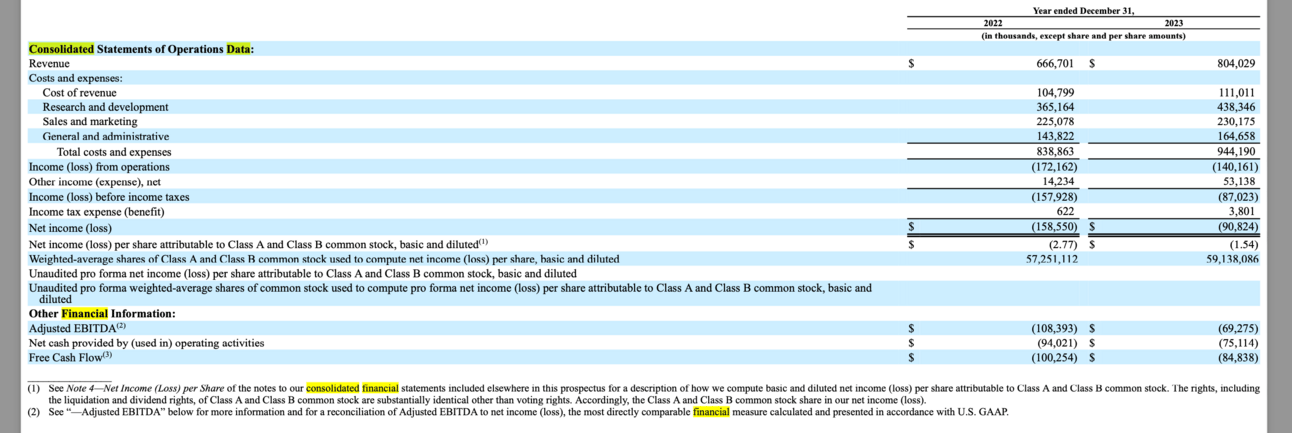

Horizontal Analysis of Income Statement (Year-Over-Year Comparison for 2023 vs. 2022):

Horizontal Analysis of Income Statement (Year-Over-Year Comparison for 2023 vs. 2022):

This analysis shows the growth rates or declines in each line-item year over year.

- Revenue: Increased by 21%

- Cost of Revenue: Increased by 6% ($6.2 million)

- Research and Development: Increased by 20% ($73.2 million)

- Sales and Marketing: Increased by 2% ($5.1 million)

- General and Administrative: Increased by 14% ($20.8 million)

- Other Income (Expense), Net: Increased by 273% ($38.9 million)

- Net Income (Loss): Improved by 43% (Reduction in loss from $158.6 million to $90.8 million)

- Free Cash Flow: Improved, decreasing loss from $(100.3) million to $(84.8) million

Conclusion:

The vertical analysis shows that while the company still operates at a loss, there was a significant improvement in the loss from operations and net loss as a percentage of revenue from 2022 to 2023. The horizontal analysis highlights a strong increase in revenue and a notable decrease in the net loss amount, which suggests an improvement in the company’s performance and cost management year over year.

Prompt: Act as an expert financial analyst. Calculate all the important financial ratios.

Reddit’s S1

The provided snippets from the financial documents contain the necessary information to calculate some of the financial ratios as requested. Here are the calculations based on the year ended December 31, 2023:

Net Income (Loss): $(90,824) thousand

Total Stockholders' Equity (Deficit): $(412,922) thousand

Total Assets: $1,596,467 thousand

Adjusted EBITDA: $(69,275) thousand

Revenue: $804,029 thousand

1. Price-to-Earnings (P/E) Ratio: This ratio requires the company's stock price, which is not available in the financial data provided. The P/E ratio would be calculated as the share price divided by the earnings per share (EPS). Since the company had a net loss, the P/E ratio is not applicable.

2. Return on Equity (ROE): Net Income / Average Stockholders' Equity

- ROE for 2023 = $(90,824) thousand / $(412,922) thousand = Not meaningful as the company has a deficit in equity.

3. Return on Assets (ROA): Net Income / Total Assets

- ROA for 2023 = $(90,824) thousand / $1,596,467 thousand = -5.69%

4. EBITDA Margin: Adjusted EBITDA / Revenue

- EBITDA Margin for 2023 = $(69,275) thousand / $804,029 thousand = -8.61%

These ratios provide insights into the company's profitability, asset efficiency, and earnings before interest, taxes, depreciation, and amortization in relation to its revenue. However, the ROE cannot be meaningfully calculated due to the negative equity, and the P/E ratio cannot be computed without the current share price. Additionally, the ROA and EBITDA margin are negative, reflecting the company's losses during the period.

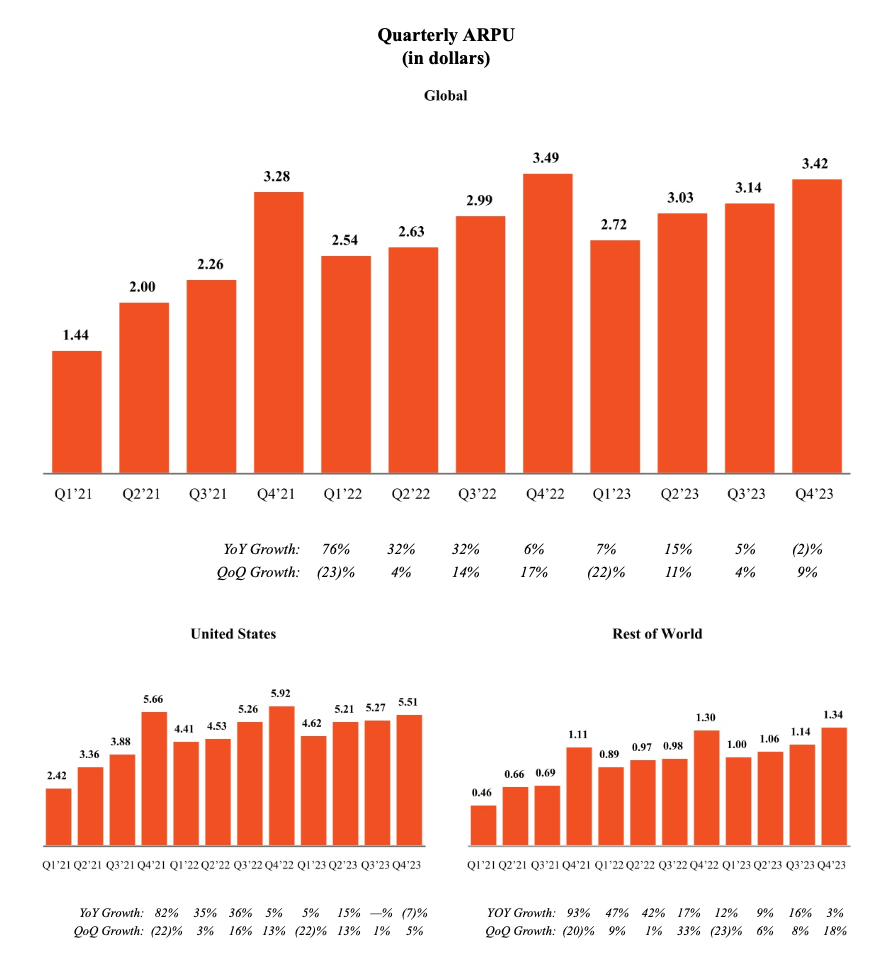

Prompt: Calculate the APRU for Reddit

To compute the Average Revenue Per User (ARPU), we use the formula:

ARPU = {Total Revenue}/ {Average Number of Users}

From the information provided:

- The total revenue for the year ended December 31, 2023, is $804,029 thousand.

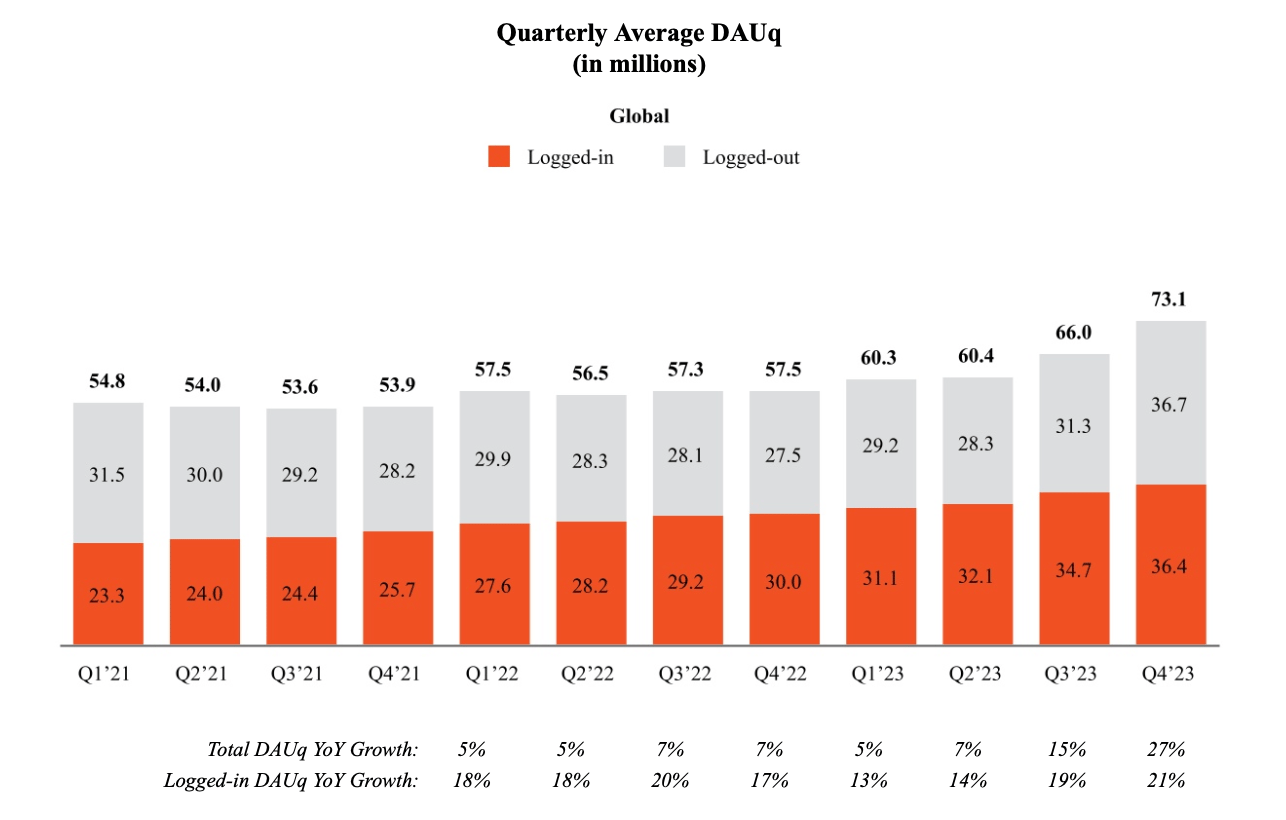

- The DAU (Daily Active Users) count for Q4 2023 is 73.1 million.

Assuming the DAU count represents the average number of users for the purpose of this calculation (which is typical in many ARPU calculations, although some companies may choose to use Monthly Active Users or a different metric), we can proceed to calculate the ARPU.

Let's calculate the ARPU now.

The Average Revenue Per User (ARPU) for the year ended December 31, 2023, based on the Q4 2023 DAU, is approximately $11.00.

Prompt: Calculate employee productivity ratios using the number of employees from the upload that I gave you.

Reddit had 2,013 full-time employees as of December 31, 2023.

To calculate employee productivity, we can use metrics such as revenue per employee, which is a common measure of how efficiently a company utilizes its workforce to generate revenue.

Reddit’s S1

Revenue per Employee Calculation:

{Revenue per Employee} = {Total Revenue}/ {Number of Employees}

Given the total revenue for the year ended December 31, 2023, is $804,029 thousand, and the number of employees is 2,013, let's calculate the revenue per employee.

The revenue per employee for Reddit in the year ended December 31, 2023, was approximately $399,418. This figure indicates the average amount of revenue generated by each employee during that year, reflecting the company's efficiency in leveraging its workforce to generate revenue.

Prompt: Based on all the analysis that you have done so far, is Reddit’s IPO worth investing in?

Based on the information provided in the S1 filing, there are several factors to consider when evaluating whether to invest in Reddit's IPO. Here are key points to consider:

Evaluation Basis:

1. User Base and Engagement:

- Reddit's success is closely tied to its user base and engagement levels. A decline in user numbers or engagement could harm the business, financials, and prospects significantly.

2. Content Contribution:

- The value and appeal of Redditors' content contributions are crucial for maintaining user engagement. A decline in valuable or appealing content could lead to a loss of users and advertisers, impacting the business negatively.

3. Brand Reputation:

- Reddit's business relies on a strong brand and reputation. Failure to maintain and enhance these aspects could impair the ability to expand the user and advertiser bases, affecting the business, financials, and prospects.

4. Monetization Challenges:

- Reddit is in the early stages of monetizing its business, with uncertainties about scaling for future growth. The heavy reliance on advertising revenue poses risks if new advertisers are not attracted or existing ones reduce their budgets.

5. Financial Performance:

- Reddit has a history of net losses, making profitability uncertain. Fluctuations in quarterly results make predictions challenging, adding complexity to investment decisions.

Reddit S1

6. Data Licensing and User Economy:

- Reddit sees opportunities in data licensing and developing a user economy through commerce initiatives. These areas present growth potential but also come with inherent risks and uncertainties.

Should You Invest In the Reddit IPO?

- Investing in Reddit's IPO involves risks related to user base, engagement, brand reputation, financial performance, and monetization challenges highlighted in the S1 filing.

- Consider the growth potential of Reddit's unique platform, its initiatives to enhance monetization through advertising and commerce, and the value of its data for future opportunities.

- Evaluate your risk tolerance, investment goals, and confidence in Reddit's ability to address challenges and capitalize on growth opportunities.

Before making an investment decision, carefully review all the risks outlined in the S1 filing under "Risk Factors" and consider seeking advice from financial professionals to assess whether investing in Reddit's IPO aligns with your investment strategy and risk profile.

Support & Sponsor

Forwarded this email by someone, and you want to subscribe?

You can help us spread the word by sharing this Newsletter with a friend or colleague.

To sponsor this Newsletter, subscribed to by startup founders and business leaders, write to sponsor@onemorethinginai.com

This Newsletter is distributed on LinkedIn and by email. Circulation is counted on both platforms.

Hit the subscribe button to receive the Newsletter as soon as it is published. If you want to interact with me on social media, follow me on LinkedIn and Twitter.

Disclosure: Some of the links in this Newsletter are affiliate links, which means we may earn a small referral fee at no extra cost to you if you purchase from them. I personally test out the AI tools during my review process. Your support helps keep this Newsletter running—thank you!