Special Edition #16: One More Thing in AI takes on the Reddit S1

Date: 9-Mar-2024

Hello {{first name | reader}},

Confession time—I am a bit of a tech and finance geek. There's a certain joy in delving into tech companies' S1 filings. When I get time, I like to break down interesting S1s on my blog (wwwdotrenjitphilipdotcom).

I wanted to dive into the Reddit S1 as soon as it was filed, but unfortunately, my schedule with other projects prevented me. It is a vast document to digest (250+ pages!) But wait a second—could I use Gen AI to solve this for me?

The answer is below (along with the prompts that I used).

Best,

Renjit Philip

Reddit S1 analysis

Reddit Logo

My first stop was Perplexity AI. What drew me to Perplexity was its remarkable control over hallucination, a feature that truly sets it apart as an 'answer engine'. Of course, I had to ask the right questions and provide clear prompts. But when I did, the results were nothing short of excellent. You can check out the complete analysis at the link below.

Perplexity is an excellent tool for analyzing text but is unsuitable for financial calculations. However, Chat GPT 4 (paid version) can solve this problem. Although GPT4 may not excel in math, it can break down your request into word problems and then use its coding engine to do the necessary calculations. As GPT4 is multimodal, it can read numbers from images and tables and even make sense of whether they are in the ‘000s or millions. This is quite impressive for an LLM, although it's trivial for a human. I have manually cross-checked the figures and the calculations using my trusted Casio Fx 350TL Pro, which I last used extensively during my MBA days.

The idea is to give you the prompts to do a similar analysis on your own.

The more significant issues that I hope to answer with this exercise are:

1) Are LLMs a productivity enhancer tool for a financial analyst who understands the right questions to ask?

2) Will a well-trained GPT replace lower-level financial analyst-type jobs?

I will leave you to read the complete analysis and draw conclusions.

Analysis begins

Prompt for Analysis of Reddit Inc.'s S-1 Filing:

“Act as an expert financial analyst, use the S1 that I uploaded for the rest of the work. Based on the detailed information provided in the S-1 filing of Reddit Inc., please conduct an analysis focusing on the following key parameters to determine the company's suitability for investment:

1. Financial Performance: Evaluate Reddit's financial health, revenue growth, profitability, and cash flow statements to assess its stability and potential returns.

2. User Base and Engagement: Examine metrics like Daily Active Users (DAU) and user engagement trends to understand the platform's popularity and growth prospects.

3. Brand Strength: Assess Reddit's brand reputation, market positioning, and ability to attract users and advertisers as crucial factors for investment suitability.

4. Risk Factors: Consider the risks highlighted in the filing, such as user base fluctuations, content contribution sustainability, profitability challenges, regulatory risks, and market volatility, to make informed investment decisions.

5. Monetization Strategy: Evaluate Reddit's plans for monetization through advertising revenue models and future growth strategies to gauge its revenue generation potential.

6. Legal and Regulatory Compliance: Review how Reddit addresses legal obligations, industry standards, and regulatory requirements to ensure compliance and mitigate legal risks associated with the investment.

7. Corporate Governance Structure: Analyze the multi-class structure of Reddit's common stock, voting control distribution, governance agreements, and their impact on decision-making processes for a comprehensive investment assessment.

8. Market Potential: Evaluate Reddit's market opportunity, competitive landscape, unique data advantage, intellectual property strength, and growth potential in the digital space to understand its future prospects for investors.”

Note: The above prompt was used on Perplexity ai (free version), after uploading the Reddit S1. I then dove deeper into each of the points of interest for me.

Output from the LLM:

1. Financial Performance:

Reddit Inc. is offering shares of its Class A common stock in its initial public offering, with an estimated price range per share. To assess financial health and potential returns, a detailed evaluation of the company's revenue growth, profitability, and cash flow statements is essential.

2. User Base and Engagement:

With a significant user base and engagement metrics like Daily Active Users (DAU), Reddit's popularity and growth prospects are noteworthy. Understanding these trends is crucial for evaluating the platform's potential.

3. Brand Strength:

Assessing Reddit's brand reputation, market positioning, and its ability to attract users and advertisers will be pivotal in determining its investment suitability.

4. Risk Factors:

The filing highlights various risks such as user base fluctuations, content sustainability challenges, regulatory risks, and market volatility. These risks need thorough evaluation before making investment decisions.

5. Monetization Strategy:

Reddit's plans for monetization through advertising revenue models and future growth strategies should be analyzed to gauge its revenue generation potential.

6. Legal and Regulatory Compliance:

Ensuring Reddit's compliance with legal obligations, industry standards, and regulatory requirements is crucial to mitigate legal risks associated with the investment.

7. Corporate Governance Structure:

The multi-class structure of Reddit's common stock, voting control distribution, governance agreements, and their impact on decision-making processes should be carefully considered for a comprehensive investment assessment.

source Reddit S1

8. Market Potential:

Evaluating Reddit's market opportunity, competitive landscape, unique data advantage, intellectual property strength, and growth potential in the digital space will provide insights into its future prospects for investors.

Prompt: Find out the demographics and characteristics of Reddit users by Age, Gender, Income, and other parameters

The user demographics of Reddit, as per the S1 filing, provide insights into the characteristics of its user base:

- Age Distribution:

- For Redditors in the United States aged 18 and over, as of the three months ended December 31, 2023, 41% were between the ages of 18 to 34.

- Gender Distribution:

- Among Redditors in the United States aged 18 and over during the same period, 50% were male.

- Income Levels:

- In terms of household annual income, 64% of Redditors in the United States had an income of $75,000 or more.

- Activity on Social Media Platforms:

- A significant portion of Reddit users are not active on traditional social media platforms. For instance, for those who visited Reddit in the United States during the three months ended December 31, 2023, 32% were not active on Facebook, 37% were not active on Instagram, 73% were not active on Snapchat, 41% were not active on TikTok, and 53% were not active on X.

source Reddit S1

Prompt: From the S1, explain what Reddit is and how users interact /use it

Reddit operates as a global digital city where users can join communities to engage in authentic conversations, share knowledge, explore passions, exchange goods and services, and find a sense of belonging. Here is an overview of how Reddit works, and its key components based on the provided information:

Components of Reddit:

1. Subreddits:

- Reddit's communities are organized into subreddits based on specific interests denoted by "r/". For example, r/explainlikeimfive offers simplified explanations, r/lgbt supports identity exploration, and r/BeyondTheBump assists with the transition to parenthood.

2. User Engagement:

- Redditors actively participate by shaping communities, sharing experiences, providing support, and even developing tools to enhance their communities. Users contribute through content sharing, upvoting or downvoting posts, and commenting.

3. Community Building:

- Redditors not only create and build communities but also volunteer as moderators to maintain community safety and vibrancy. The platform empowers users to shape Reddit by creating content, engaging in discussions, and contributing to community growth.

4. Evolution of Subreddits:

- Newly created subreddits foster a sense of belonging among members, leading to the creation of more subreddits. This continuous cycle allows Reddit's community ecosystem to expand based on user interests and passions.

User Interaction on Reddit:

- Content Creation: Users share diverse content like links, images, videos, and text posts within subreddits.

- Voting System: Posts start with one upvote and gain visibility through community upvotes. Voting is anonymous and determines content prominence.

- Community Moderation: Each subreddit has tailored rules enforced by volunteer moderators to maintain a harmonious environment.

- Recommendations: Reddit's community-powered recommendations are trusted by users seeking authentic advice and product suggestions.

- Flexible Expression: Subreddits offer customizable experiences for communities through various formats like text, images, videos, polls, and chatrooms.

- Engagement Growth: Reddit aims to enhance user engagement by improving content discovery, user experience, video content, conversations, search functionality, and community moderation.

In essence, Reddit thrives on shared interests, human creativity, and trust among its diverse user base. The platform's unique structure allows users to explore a wide range of topics, engage in meaningful discussions, seek recommendations from trusted sources, and contribute to a vibrant digital community ecosystem.

source Reddit S1

Prompt: Do a Detailed Evaluation of Reddit Inc.'s Revenue Growth, Profitability, and Cash Flow Statements

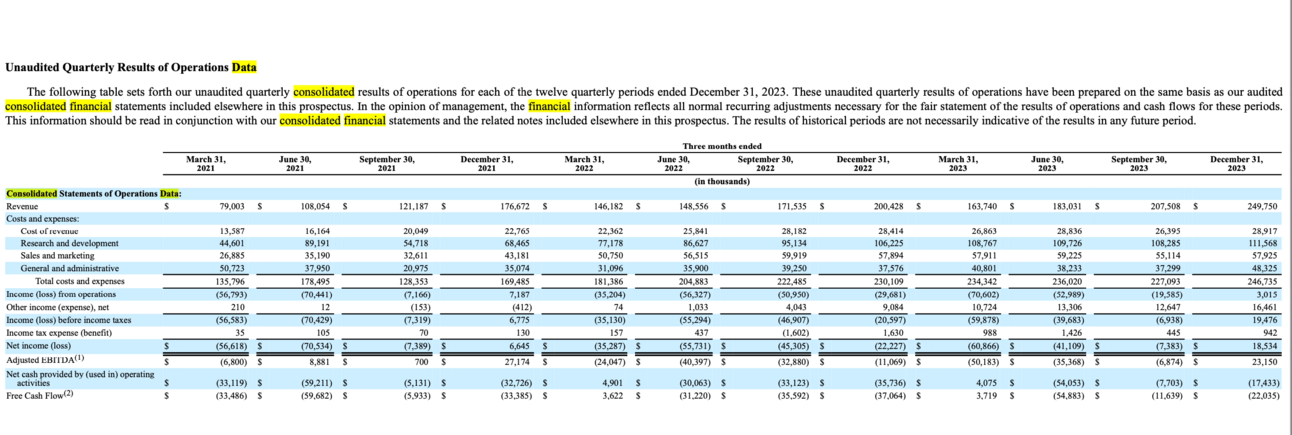

Revenue Growth:

- Revenue Trends: Reddit Inc. experienced revenue growth from $666.7 million in 2022 to $804.0 million in 2023.

- Costs and Expenses: The company's cost of revenue, research and development, sales and marketing, and general and administrative expenses increased from 2022 to 2023, impacting its overall profitability.

Profitability:

- Income from Operations: Reddit Inc. reported a decrease in losses from operations, improving from $(172.2) million in 2022 to $(140.2) million in 2023.

- Net Income: The company's net losses decreased from $(158.6) million in 2022 to $(90.8) million in 2023.

- Net Income per Share: The net income (loss) per share attributable to Class A and Class B common stock improved from $(2.77) in 2022 to $(1.54) in 2023.

Cash Flow Statements:

- Operating Activities: Net cash provided by (used in) operating activities improved from $(94.0) million in 2022 to $(75.1) million in 2023.

- Free Cash Flow: Reddit Inc.'s Free Cash Flow, representing the ability to generate or use cash after meeting business needs and obligations, showed an improvement from $(100.3) million in 2022 to $(84.8) million in 2023.

In summary, Reddit Inc. demonstrated positive trends in revenue growth, reduced losses from operations, improved net income figures, and enhanced cash flow metrics between the years ended December 31, 2022, and 2023. These improvements indicate progress towards financial stability and potential for future growth within the company's operations.

Prompt: Do an Analysis of User Base and Engagement Metrics in Reddit Inc.'s S-1 Filing

User Metrics:

- Daily Active Users (DAUq): Reddit defines DAUq as a user who has visited the Reddit website or opened the Reddit application at least once during a 24-hour period. The company's success is significantly tied to growing its user base and increasing user engagement, particularly DAUq.

- Weekly Active Uniques (WAUq): Reddit also measures WAUq to understand the reach of its platform and the engagement levels of its users.

Prompt: Do a Comparison of these metrics with Public Social Media Companies like Meta:

- User Engagement: Reddit's emphasis on user engagement through unique content curation and community-driven interactions sets it apart from platforms like Meta (formerly Facebook). While Meta focuses on social connections and personal networks, Reddit's community ecosystem is built on shared interests, passions, and trust, fostering a unique sense of belonging and authenticity for users.

- Advertising Engine: Reddit's advertising platform is distinct due to its intentional, authentic, and trusted nature, offering advertisers access to a highly engaged audience where passionate communities influence brand recommendations. This differs from Meta's advertising model, emphasizing contextual and interest-based advertising that resonates with users seeking trustworthy recommendations.

Conclusions and Recommendations:

1. User Growth Strategy: Reddit's strategy to increase user engagement by improving discovery, user experience, and content classification through machine learning is commendable. To sustain growth, the company should focus on converting monthly users into daily active users effectively.

2. Monetization Opportunities: Leveraging Reddit's unique community structure and interest-driven model for advertising presents significant revenue potential. The company should continue expanding its ad platform capabilities to attract more advertisers and increase average revenue per user.

3. Competitive Positioning: Reddit's emphasis on authentic interactions, human curation, and community-based content sets it apart from traditional social media platforms like Meta. Capitalizing on these strengths can help Reddit maintain its competitive edge in the digital space.

4. Risk Mitigation: Addressing potential risks related to user growth, engagement declines, competition, and platform disruptions is crucial for sustaining Reddit's success. Proactive measures to combat harmful usage, enhance privacy controls, and maintain user trust are essential for long-term viability.

Note: Some of these conclusions are blindingly obvious! LLM needs to learn precis writing.

Prompt: Do a Comparison of Reddit Inc. with Google/Alphabet, specifically in the Search Business

- User-Generated Content: Reddit has evolved into a vast repository of information with over one billion posts and 16 billion comments by December 31, 2023. Its user-generated content is crucial for AI development and training large language models.

- Monetization Strategy: Reddit aims to enhance value for advertisers through its interest- and community-based platform, expanding ad platform capabilities to drive business growth. The company focuses on diversifying revenue streams and increasing average revenue per user.

- Data Licensing: Reddit recognizes the value of its data for sentiment analysis and trend identification, offering third parties access to historical and real-time data through data APIs. This data advantage is essential for training future large language models.

Google/Alphabet (Search Business):

- Search Engine Traffic: Google plays a vital role in generating traffic for websites like Reddit through organic searches. Changes in search engine algorithms can impact website visibility and traffic, affecting business operations and prospects.

- Search Advertising Opportunity: Google's search advertising market is estimated to be a $750 billion opportunity by 2027. Companies like Reddit can tap into this market by leveraging search capabilities to enhance advertising revenue.

- Data Licensing Potential: With the growing importance of data in AI applications, Google's data licensing opportunities are significant. Access to real-time data streams and historical information can fuel AI development and analytics.

Prompt: Do an assessment of Reddit Inc.'s Brand Reputation, Market Positioning, and User & Advertiser Attraction

Brand Reputation:

- Empowering Environment: Reddit's brand identity is centered around providing an empowering environment for users, fostering a sense of belonging, privacy, and authenticity. This reputation has significantly contributed to the success of the platform.

- Maintaining Brand Image: Reddit acknowledges the importance of maintaining and enhancing its brand and reputation to retain and grow its user and advertiser bases. This involves providing high-quality, relevant, reliable, trustworthy, and innovative products while addressing potential risks related to content, user behavior, and advertising impact.

Market Positioning:

- Community Ecosystem: Reddit's community ecosystem is built on shared interests, passions, and trust rather than personal connections like friends or celebrities. This unique positioning offers users a distinct sense of belonging and authenticity.

- Advertising Engine: Reddit's advertising platform is designed around context and user interest, offering advertisers access to a highly engaged audience where trusted communities influence brand recommendations. The platform's intentional, authentic, and trusted nature sets it apart in the advertising space.

User & Advertiser Attraction:

- User Engagement: Reddit aims to grow its user base by improving discovery, user experience, and content classification through machine learning. The platform seeks to convert monthly users into daily active users to enhance engagement levels.

- Advertising Revenue: Reddit's advertising business is evolving rapidly, with advertisers recognizing the platform as a valuable space to reach high-intent customers through contextual and interest-based advertising. The company plans to expand its ad platform capabilities to attract more advertisers and increase revenue per user.

Recommendations:

1. Brand Management:

- Reddit should continue investing in maintaining and enhancing its brand image by prioritizing high-quality content, user trust, and innovative product offerings.

- Proactive measures should be taken to address potential risks related to offensive content, misleading advertisements, or negative user behavior that could impact the brand reputation.

2. Market Expansion:

- Expanding Reddit's reach through strategic partnerships, SEO optimization, and off-platform presence can help attract new users and increase engagement levels.

- Leveraging the unique community ecosystem and interest-based advertising model can further enhance Reddit's attractiveness to advertisers seeking authentic engagement with high-intent audiences.

3. User & Advertiser Growth:

- Reddit should focus on converting more monthly users into daily active users by improving discovery features and enhancing the overall user experience.

- Continued investment in expanding advertising capabilities, diversifying advertiser types and geographies, and optimizing ROI for marketers can drive revenue growth and increase average revenue per user.

Prompt: Do an Analysis of Reddit Inc.'s Monetization Strategies and Revenue Generation Potential

Monetization Strategies:

- Diversification Efforts: Reddit is exploring various revenue streams beyond advertising, including the Reddit Contributor Program, Reddit Collectible Avatars, and data licensing opportunities. These initiatives aim to provide Redditors with ways to earn money on the platform while generating revenue for Reddit.

- Data Licensing: Reddit is considering data licensing as a potential revenue source, leveraging its vast corpus of user-generated content for sentiment analysis and trend identification. This approach aligns with the company's values and aims to balance revenue generation with user rights and privacy considerations.

- Advertising Focus: While exploring new revenue streams, advertising remains Reddit's primary revenue source. The platform attracts advertisers by offering access to a unique and highly engaged audience through contextual and interest-based advertising. Reddit plans to expand its ad platform capabilities to drive revenue growth.

Revenue Generation Potential:

- Advertising Revenue: Reddit generates a significant portion of its revenue from advertising, with approximately 98% of its revenue coming from third-party advertising on the platform. The company's top ten largest customers accounted for a substantial portion of its revenue in recent years.

- User Economy Commerce: Reddit's user-powered economy is evolving, with community-based marketplaces emerging for commercial purposes. Initiatives like the Collectible Avatars Creator Program aim to incentivize content creation and drive engagement while opening new monetization channels for the platform

- Market Opportunities: Reddit sees growth opportunities in advertising, monetizing commerce on the platform, and licensing data. The company aims to expand its ad platform capabilities, enhance commerce opportunities for users, and tap into the potential of data licensing as part of its future growth strategies.

Revenue Growth Strategies:

1. Advertising Expansion:

- Reddit plans to enhance its ad platform capabilities by incorporating more contextual and interest-based signals to help advertisers reach relevant audiences. This includes exploring new ad placements like ads in comment threads and on search pages to improve user engagement and ROI for advertisers.

2. Commerce Monetization:

- By developing tools and incentives for users and creators to drive content creation, improvements, and commerce on the platform, Reddit aims to open additional monetization channels beyond advertising. Initiatives like community marketplaces and the Collectible Avatars Creator Program are key components of this strategy.

3. Data Licensing Opportunities:

- Recognizing the value of its data for AI applications, Reddit plans to explore data licensing opportunities further. Leveraging its vast corpus of conversational data can position Reddit well in the AI market landscape and contribute to future revenue growth.

By focusing on diversifying revenue streams through innovative initiatives like the Contributor Program, Collectible Avatars, and data licensing opportunities while maintaining a strong emphasis on advertising as a primary revenue source, Reddit Inc. aims to drive sustainable growth, enhance user engagement, and attract advertisers through unique monetization strategies tailored to its community-driven ecosystem.

source Reddit S1

Prompt: Do an Expert Analysis of Reddit's Market Opportunity and Growth Potential

Market Opportunity:

- User Economy Commerce: Reddit has organically developed a user-powered economy with community-based marketplaces like r/PhotoShopRequest and r/RandomActsofCards. This entrepreneurial spirit among Redditors presents growth opportunities for commerce on the platform, enabling users and creators to drive creation, improvements, and commerce. Initiatives to support this user-powered economy aim to open additional monetization channels for Reddit.

- Data Advantage: Reddit's vast archive of real, timely, and relevant human conversation serves as a valuable dataset for various purposes such as search, AI training, and research. With over one billion posts and 16 billion comments through December 31, 2023, Reddit's unique data advantage positions it as a valuable resource for AI technology and large language models (LLMs). The platform's human-focused solutions in an increasingly data-driven world offer significant growth potential.

Competitive Landscape:

- Advertising Revenue: Reddit's primary revenue source is advertising, attracting advertisers by providing access to a unique and highly engaged audience. The platform's advertising capabilities enable marketers to reach high-intent customers through contextual and interest-based advertising. Reddit's focus on expanding its ad platform capabilities and enhancing advertiser ROI reflects its competitive stance in the digital advertising space.

- User Engagement: Reddit aims to become Redditors' first choice for exploring passions, entertainment, culture, and news. With initiatives to improve discovery, user experience, conversations, video content, search functionality, and customized content recommendations, Reddit seeks to grow user engagement by converting weekly or monthly users into daily users. These efforts align with the platform's strategy to enhance user engagement and drive growth.

Intellectual Property Strength:

- Data Licensing: Reddit is exploring data licensing opportunities as a revenue source by allowing third parties to access real-time data streams of public discussions on the platform through data APIs. Leveraging its massive corpus of conversational data and knowledge, Reddit aims to play a key role in training future LLMs and AI technologies. This intellectual property strength positions Reddit as a valuable resource for organizations utilizing data-driven analytics and AI applications.

Growth Potential:

- Monetization Strategies: Reddit's growth opportunities lie in advertising expansion, monetizing commerce on the platform, and licensing data. By focusing on enhancing its ad platform capabilities, developing new ways for users to earn money on the platform, and leveraging its unique data advantage for licensing opportunities, Reddit aims to drive revenue growth and expand its business. The platform's commitment to making Reddit faster, easier to use, and more engaging underscores its growth potential in the digital space.

In conclusion, Investors can consider Reddit's innovative approach towards user engagement, data utilization, and revenue diversification as key factors contributing to its future prospects in the digital landscape.

Prompt: Do a deep dive into the Total Addressable Market for Reddit

The market opportunities presented in the provided document for Reddit are as follows:

1. Advertising Market:

- Reddit estimates its total addressable market globally from advertising, excluding China and Russia, to be $1.4 trillion by 2027. This market includes desktop and mobile web, display, video, social direct response ads, and search advertising. The digital advertising market is expected to grow at a CAGR of 8% to reach $1.4 trillion in 2027.

2. Data Licensing:

- Reddit sees an emerging opportunity in data licensing due to the value of its data in sentiment analysis and trend identification. The broader AI market, excluding China and Russia, is expected to grow at a CAGR of 20% to $1.0 trillion by 2027. Reddit aims to tap into this market by leveraging its data for analytics, AI training, and generative AI platforms.

3. User Economy:

- Reddit recognizes the potential in enabling developers to add functionality to communities for economic features like games and commerce. The user economy market size is estimated to be $1.3 trillion today across six core geographies and is projected to grow at a CAGR of 12% to $2.1 trillion by 2027. Reddit aims to generate revenue based on the volume of commerce conducted on its platform.

These figures outline the significant market opportunities that Reddit aims to capitalize on across advertising, data licensing, and the user economy segments as part of its strategic growth initiatives.

Prompt: Find out the Competitors of Reddit in Various Domains

Reddit faces competition from various platforms across different domains, each presenting unique challenges and opportunities. Here are the competitors identified in the S1 filing and an explanation of the domains they operate in:

1. Online Marketplaces:

- Competitors: Facebook Marketplace, Nextdoor, Craigslist, Poshmark, Etsy, Roblox.

- Domain Explanation: These platforms offer online marketplaces for buying and selling goods and services. They compete with Reddit's community-based commerce initiatives and user-to-user marketplaces.

2. Large Language Models (LLMs):

- Competitors: ChatGPT, Gemini, Anthropic.

- Domain Explanation: LLMs provide advanced language processing capabilities that can impact how users access information. Reddit competes with these models as they may offer alternative ways for users to find information instead of directly visiting Reddit.

Explanation of Domains:

- Advertising: Reddit's core monetization is through advertising solutions based on user engagement. The platform aims to expand its advertising revenue by attracting more advertisers and enhancing its ad platform capabilities to drive business growth.

- Data Licensing: Reddit sees an emerging opportunity in data licensing due to the value of its data in sentiment analysis and trend identification. This domain involves providing data to organizations for analytics and AI applications, positioning Reddit well in the broader AI market.

- User Economy: With a focus on enabling developers to add functionality to communities and fostering economic features like games, Reddit aims to develop a user economy where commerce of digital goods, services, and physical goods can thrive within its platform.

Prompt: Are there any other competitors?

Additional Competitors:

1. Online Advertising Platforms:

- Competitors: Google Ads, Facebook Ads, Twitter Ads, LinkedIn Ads. - Domain Explanation: These platforms offer online advertising solutions similar to Reddit's ad platform. They compete for advertisers looking to reach specific audiences and engage with users through targeted advertising campaigns.

2. Social Media Platforms:

- Competitors: Facebook, Twitter, Instagram, TikTok.

- Domain Explanation: Social media platforms like Facebook and Twitter compete with Reddit for user engagement and attention. They offer similar features for users to interact, share content, and connect with communities, posing competition in the social media space.

3. E-commerce Platforms:

- Competitors: Amazon, eBay, Shopify.

- Domain Explanation: E-commerce platforms like Amazon and eBay provide online marketplaces for buying and selling goods. They compete with Reddit's community-based commerce initiatives and user-to-user marketplaces by offering a wide range of products and services to consumers.

Explanation of Domains:

- Online Advertising: Competitors in this domain offer advertising solutions that target specific audiences across various platforms. Reddit competes with these platforms to attract advertisers looking to promote their products or services online.

- Social Media Engagement: Social media platforms are competitors in engaging users and fostering communities online. Reddit competes with these platforms for user attention and interaction within different interest groups and communities.

- E-commerce Competition: E-commerce platforms provide avenues for buying and selling goods online. Reddit's commerce initiatives face competition from these established platforms that offer a wide range of products and services to consumers.

These additional competitors operate in domains such as online advertising, social media engagement, and e-commerce, posing challenges for Reddit in attracting users, engaging audiences, and driving revenue growth within these competitive landscapes.

Prompt: List out Reddit’s go to market strategy and sales motion for small businesses and international advertisers

Reddit accesses small business advertisers and international advertisers through a strategic approach that involves various elements to attract and engage these advertiser segments. Here are the key strategies outlined in the S1 filing:

1. Geographic Market Focus:

- Reddit has teams, channel partners, or vendors in different geographic markets to manage small- and mid-size businesses globally. This localized presence allows Reddit to effectively engage with advertisers in various regions.

2. AI-Powered Audience Reach and Bidding:

- Utilizing machine learning models, Reddit optimizes contextual keyword audience reach and interest-based audience reach to help advertisers effectively target audiences. Auto-bidding strategies are employed to maximize campaign objectives efficiently.

3. Expanded Formats and Offerings:

- Reddit continuously develops new ad positions based on evolving consumer behaviors on the platform, such as video and search usage growth. This expansion of ad formats enables advertisers to creatively engage with communities and share more information.

4. Automation/Scale Service Model:

- Reddit aims to scale its service model through diverse service channels tailored to client needs, ranging from managed service models to enabling advertisers to activate with minimal sales team assistance (unmanaged). Automation simplifies manual optimization tasks for better outcomes and performance.

5. Acquiring More Advertisers:

- By focusing on automation, Reddit aims to become more accessible to a larger portion of small- and medium-sized businesses through partnerships and accelerated demand generation. This strategy is aimed at expanding Reddit's advertiser base globally.

These strategies collectively enable Reddit to access small business advertisers and international advertisers by leveraging geographic market focus, AI-powered audience targeting, expanded ad formats, automation for scalability, and efforts to attract a broader range of advertisers globally.

Prompt: What can you find out about Reddit’s sales structure and process?

The structure of Reddit's sales team is designed to effectively cater to the needs of advertisers and drive revenue growth through various strategies. Based on the information provided in the S1 filing, here is an overview of how Reddit's sales team is structured:

1. Geographic Market Focus:

- Reddit has teams, channel partners, or vendors in different geographic markets to manage small- and mid-size businesses globally. This approach allows Reddit to have a localized presence and better serve advertisers in various regions.

2. Demonstrating ROI:

- The sales team focuses on improving the measurement of ads to provide better data showcasing the return on investment for advertisers. This includes enhancing tools for conversion tracking, conducting brand and conversion-lift testing, and adopting more measurement pixel tools.

3. AI-Powered Audience Reach and Bidding:

- Utilizing machine learning models, the sales team optimizes contextual keyword audience reach and interest-based audience reach. Ads are ranked based on brand suitability and predicted user engagement. Auto-bidding strategies help advertisers maximize campaign objectives efficiently.

4. Expanded Formats and Offerings:

- The sales team works on developing new ad positions based on evolving consumer behaviors on the platform, such as video and search usage growth. They aim to expand ad formats to allow advertisers to creatively engage with communities and share more information like product-level creative and games.

5. Automation/Scale Service Model:

- Reddit aims to scale its service model through diverse service channels tailored to client needs. This includes managed service models, hybrid approaches, and enabling advertisers to activate with minimal sales team assistance (unmanaged). Automation simplifies manual optimization tasks for better outcomes and performance.

6. Acquiring More Advertisers:

- With a focus on automation, Reddit aims to become more accessible to a larger portion of small- and medium-sized businesses through partnerships and accelerated demand generation. This strategy is geared towards expanding Reddit's advertiser base and driving revenue growth.

These structural elements highlight how Reddit's sales team is organized to effectively engage with advertisers, drive ROI, leverage AI for audience targeting, expand ad formats, streamline services through automation, and attract a broader range of advertisers globally.

Prompt: Do a deep dive analysis of Reddit’s go to market approach

Reddit's go-to-market approach to attract more advertisers is multifaceted and strategic, focusing on various aspects to enhance its advertising offerings and appeal to marketers. Here are the key strategies outlined in the S1 filing:

1. Contextual and Interest-based Advertising:

- Reddit's advertising platform leverages contextual and interest-based targeting to help advertisers reach relevant audiences within contextually relevant communities and content. This approach enables marketers to engage users based on their interests and conversations, enhancing the effectiveness of ad campaigns.

2. High-Intent Audience Engagement:

- Advertisers are attracted to Reddit due to the platform's ability to connect with a high-intent audience seeking recommendations throughout the purchase journey. Users come to Reddit for trusted advice and product recommendations, making it a valuable space for advertisers looking to engage with users actively seeking information.

3. Data Signals and Privacy Respect:

- Reddit's advertising model is built on first-party data derived from user-directed activities on the platform, focusing on context and interest rather than tracking users based on personally identifiable information. This unique approach enhances privacy protection and offers a more resilient advertising solution compared to platforms reliant on third-party data.

4. Action-Oriented Outcomes:

- Advertisers on Reddit can bid in auctions based on their objectives, whether it's reaching specific audiences, driving clicks, conversions, or app downloads. This flexibility in bidding aligns with advertisers' goals and ensures measurable return on investment, driving value for advertisers.

5. Brand Safety and Customizable Controls:

- Reddit provides multiple layers of brand safety measures and customizable controls for advertisers. Beyond content moderation, the platform offers advertiser-level controls to ensure ads are displayed in safe environments alongside appropriate content, enhancing brand safety and control for advertisers.

6. Future Monetization Strategies:

- Reddit plans to expand its monetization strategies by focusing on areas such as adding more contextual and interest-based signals for advertisers, utilizing machine learning for marketplace optimizations, diversifying advertiser types and geographies, improving ROI measurement tools, expanding ad formats, enhancing automation for scalability, acquiring more advertisers through partnerships, and exploring new revenue streams beyond advertising.

Financial Analysis of Reddit’s S1 - Powered by GPT4 : Part 1

Prompt: Act as an expert financial analyst, use the S1 that I uploaded and do a comprehensive financial ratios for Reddit.

Based on the financial statements and notes provided in Reddit's S-1 filing, we can calculate several key financial ratios to analyze the company's financial health and performance. Here are the calculations for the year ended December 31, 2023, based on the provided data.

Liquidity Ratios

1. Current Ratio measures the company's ability to pay off its short-term liabilities with its short-term assets.

- Formula: Current Assets / Current Liabilities

- Calculation: $1,479,687,000 / $133,570,000 = 11.07

2. Quick Ratio indicates the company's ability to meet its short-term obligations with its most liquid assets.

- Formula: (Cash & Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

- Calculation: ($401,176,000 + $811,946,000 + $245,279,000) / $133,570,000 = 11.02

Profitability Ratios

1. Net Margin shows the percentage of revenue that remains as net income after all expenses are deducted.

- Formula: Net Income / Revenue

- Calculation: $(-90,824,000) / $804,029,000 = -11.29%

2. Return on Assets (ROA) indicates how efficiently a company can manage its assets to produce profits during a period.

- Formula: Net Income / Total Assets

- Calculation: $(-90,824,000) / $1,596,467,000 = -5.69%

3. Return on Equity (ROE) measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested.

- Formula: Net Income / Stockholders' Equity

- Given the negative equity situation ($412,922,000 in deficit), ROE is not meaningful as it indicates financial distress rather than an efficient use of equity.

Efficiency Ratios

1. Asset Turnover Ratio shows how efficiently a company can use its assets to generate sales.

- Formula: Revenue / Total Assets

- Calculation: $804,029,000 / $1,596,467,000 = 0.50

Leverage Ratios

1. Debt to Equity Ratio indicates the proportion of equity and debt the company uses to finance its assets.

- Formula: Total Liabilities / Stockholders' Equity

- Given the negative equity situation, this ratio would also not provide meaningful insight and highlights financial distress.

Market Ratios

1. Earnings Per Share (EPS) shows the portion of a company's profit allocated to each outstanding share of common stock.

- Formula: Net Income / Weighted Average Shares Outstanding

- Calculation: $(-90,824,000) / 59,138,086 shares = $-1.54 (as provided)

2. Price-to-Earnings Ratio (P/E), without the company's share price, this cannot be calculated directly from the financial statements. The P/E ratio would require the current market price per share, which is not provided in the S-1 document.

These ratios offer a snapshot of Reddit's financial condition and performance, revealing areas such as high liquidity, a strong dependency on equity financing (as evidenced by the negative stockholders' deficit), and challenges in profitability as indicated by the negative net income and ROE.

Prompt: Find out the CAC for Reddit using DAU unique as a proxy for Users in a period.

(Note: Here I had to use a chain of prompts to manually give the GPT the DAUs for 2023 and 2022. It was not able to extract from the images in S1. )

To compute the Cost of Customer Acquisition (CAC), the increase in unique Daily Active Users (DAU) will serve as a proxy for new customers acquired.

The increase in unique DAUs from the previous year is calculated as follows:

{Increase in DAUs} = {DAUs in Q4 2023} - {DAUs in Q4 2022}

{Increase in DAUs} = 73.1 { million} - 57.5 { million}

{Increase in DAUs} = 15.6 { million}

With sales and marketing expenses for 2023 totaling $230,175 thousand, the CAC is calculated as:

{CAC} = {Total Sales and Marketing Expenses} / {Increase in DAUs}

Now, let's compute the CAC.

The Cost of Customer Acquisition (CAC) for the year ended December 31, 2023, calculated based on the increase in Daily Active Users (DAUs) and the sales and marketing expenses, is approximately $14.75 per new user.

Prompt: Do a comprehensive financial analysis of the company from the document that I gave you.

Based on the data extracted from the provided financial documents, a comprehensive financial analysis is conducted as follows:

1. Revenue Analysis:

- The YoY revenue growth rate for 2023 was 21% ($137.3 million increase), indicating a solid increase in revenue streams.

- Revenue streams are primarily from advertising, with growth driven by an increase in impressions and user growth.

- Seasonality affects advertising spend, with Q4 traditionally being the highest and Q1 the lowest.

2. Expense Analysis:

- Cost of revenue grew by 6% YoY, due to higher infrastructure costs.

- R&D expenses increased by 20% YoY, primarily due to salary increases and a 7% headcount growth.

- Sales and marketing expenses had a modest increase of 2% YoY.

3. Profitability Analysis:

- The gross margin is not directly provided but can be inferred from cost of revenue and total revenue.

- Operating margin was negative for both years, showing operational costs exceeding revenue.

- Net margins improved, with a reduced net loss from $(158.6) million in 2022 to $(90.8) million in 2023.

4. Cash Flow Analysis:

- Operating cash flow was negative for both years, indicating spending more on operations than the income generated.

- Free Cash Flow worsened from $(100.3) million in 2022 to $(84.8) million in 2023, though this is a slight improvement. [ Note: GPT4 was a bit confused here by the negative cash flow!]

- There were significant cash inflows from investing activities in 2023 compared to outflows in 2022.

5. Balance Sheet Assessment:

- Working capital remains positive, indicating the company can cover its short-term obligations.

- Total assets remained stable, while total stockholders’ equity (deficit) increased slightly in the deficit.

- The company appears solvent, with no convertible preferred stock outstanding pro forma as adjusted.

6. Investment and Financing Activities:

- There was a positive net cash from investing activities, primarily due to the maturities and sale of marketable securities.

- Financing activities were not a significant source of cash in 2023.

7. Forward-Looking Analysis:

- Future growth strategies include expanding product offerings and geographic markets.

- The management's discussion notes a focus on growth and potential investments in R&D and acquisitions.

8. Ratio Analysis:

- Specific financial ratios such as PE ratio, ROE, ROA, and EBITDA margin were not provided but can be calculated from net income, equity, total assets, and Adjusted EBITDA data.

9. Risk Assessment:

- The company has noted cybersecurity risks and potential data breaches as ongoing concerns.

- Off-balance-sheet arrangements were not present during the periods provided.

10. Valuation Analysis:

- Valuation methods such as DCF cannot be directly conducted without future cash flow projections.

This analysis provides a snapshot of the financial health and operational performance of the company based on the historical data provided. The company shows growth in revenue, an increase in expenses related to growth strategies, and improvements in cash flow management year over year.

Prompt: using the data provided, do a vertical and horizontal analysis of the financials.

Given the data provided in the extracted text from the financial documents, here is a vertical and horizontal analysis of the company's financial statements:

Source: S1

Vertical Analysis of Income Statement for the Year Ended December 31, 2023:

This analysis compares each line item on the income statement as a percentage of total revenue to understand how each item contributes to the revenue.

- Revenue: 100%

- Cost of Revenue: 14% (Decreased from 16% in 2022)

- Research and Development: 55% (Consistent with 55% in 2022)

- Sales and Marketing: 29% (Decreased from 34% in 2022)

- General and Administrative: 20% (Decreased from 22% in 2022)

- Total Costs and Expenses: 118% (Decreased from 127% in 2022)

- Income (Loss) from Operations: (18%) (Improved from (27%) in 2022)

- Other Income (Expense), Net: 7% (Increased from 2% in 2022)

- Net Income (Loss): (11%) (Improved from (25%) in 2022)

Horizontal Analysis of Income Statement (Year-Over-Year Comparison for 2023 vs. 2022):

Support & Sponsor

Forwarded this email by someone, and you want to subscribe?

You can help us spread the word by sharing this Newsletter with a friend or colleague.

To sponsor this Newsletter, subscribed to by startup founders and business leaders, write to sponsor@onemorethinginai.com

This Newsletter is distributed on LinkedIn and by email. Circulation is counted on both platforms.

Hit the subscribe button to receive the Newsletter as soon as it is published. If you want to interact with me on social media, follow me on LinkedIn and Twitter.

Disclosure: Some of the links in this Newsletter are affiliate links, which means we may earn a small referral fee at no extra cost to you if you purchase from them. I personally test out the AI tools during my review process. Your support helps keep this Newsletter running—thank you!